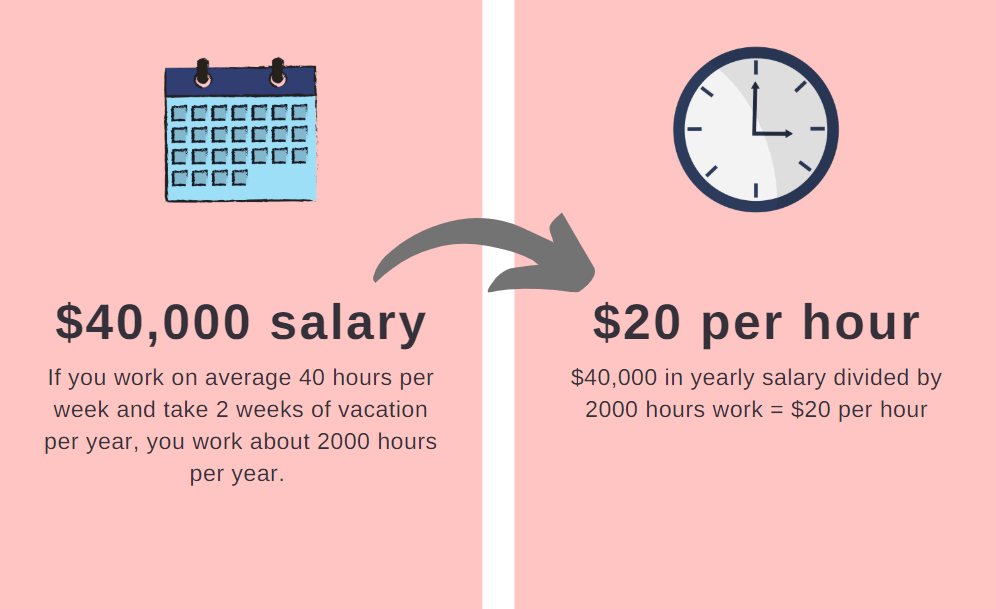

A yearly salary of $40,000 converts to an approximate hourly wage of $20 per hour.

If you work 40 hours a week and take 2 weeks of vacation per year, you work 2000 hours per year.

$40,000 / 2000 hours = $20 / hour

How to do the mental math calculation

A quick way to convert a yearly salary to an hourly rate in your head = Divide the salary by 2 and cross out 3 zeros aka divide by 1000.

- So $40,000 = $20,000.

- Then cross out 3 zeros = $20,

000and you get $20 - Let’s try it again. $100,000 / 2 = $50,000.

- Cross out 3 zeros and you get $50 per hour!

- Viola it’s that easy.

You can also do the mental math the other way from an hourly rate to a yearly salary.

- $20 per hour * 2 = $40

- Then add 3 zeros to get $40,000.

What’s your after tax hourly rate?

At an annual income of $40,000 you’ll pay about 11% in federal and state income tax. That will change sligthly depending on which state you live in or if you’re lucky enough to live in a state without income tax.

You’ll also pay about 8.25% in social security and medicare taxes.

- Federal and State Taxes = $20 * 11% = $2.2

- Social Security and Medicare = $20 * 8.25% = $1.65

- Total taxes ~ $3.85

- Your after tax hourly wage ~ $16.15

Looking for a more accurate calculation? Check out one of my favorite tools, the paycheck calculator over at smartasset.com

Learn the simple habits that can change your life

My name is Marcus and I started my professional career making $35,000 per year.

Fast forward a decade and now I’m financially independent at the ripe old age of 32. What to learn the “tricks” that helped me get there?

It’s really as simple as building systems that put my finances on autopilot, and building habits that helped me cash in on opportunities in my working career.