My favorite personal finance tool and the cornerstone of my financial dashboard.

Personal Capital provides a simple and holistic picture of your net worth. It might be the best free money management tool out there.

What is Personal Capital?

Personal Capital is a financial firm based in California. They offer free financial tools, cash management, and wealth management services.

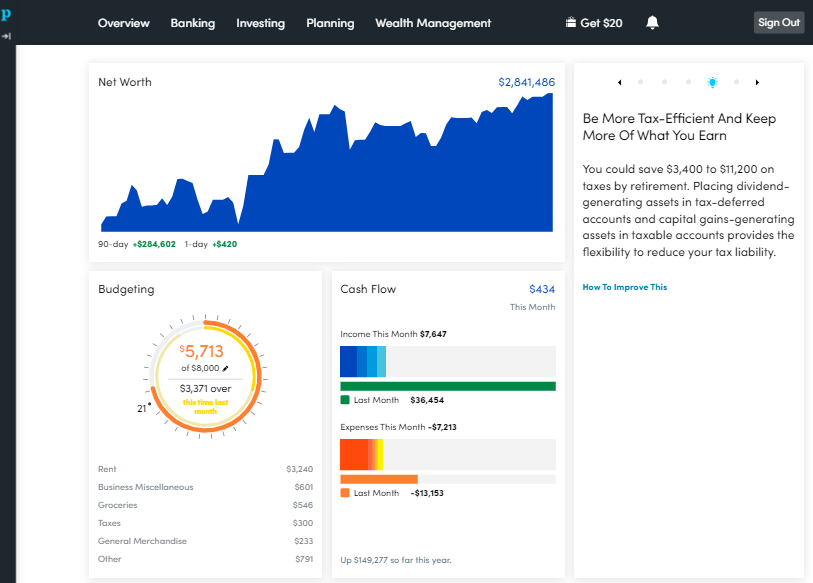

The free product aggregates all your financial data to a single place. This allows you to track your net worth and cash flows. If you have two accounts or twenty, personal capital will sync your transactions in a few minutes. The easy-to-read dashboard gives you a complete overview of your financial picture. Calculating your net worth has never been so easy.

How Does Personal Capital Work?

The first step is to create an account. You can create an account online or download the app. The app is available in the Apple App Store or Google Play Store.

Once you create your account, it’s time to link all your financial accounts. Link all your bank accounts, investment accounts, retirement accounts, and credit cards. Own a home? You can also link your house and track its value with a Zillow Zestimate.

Personal Capital uses a highly encrypted connection to download all your financial transactions. It only takes a few minutes to sync your financial dashboard. Once it’s done, you have a beautiful net worth dashboard right there on your home screen. Assets – Liabilities = Net Worth. Now every time you log into your account, you can get an updated calculation of your net worth.

My Favorite Tools and Features

Personal capital is one of my favorite financial products. It’s been extremely helpful on my path to financial independence. I use it every month as part of my simple money habits.

I used Mint for years before finding Personal Capital and making the switch. The Personal Capital product is much more net worth and investment-focused. The algorithms do a great job categorizing transactions. It’s also smart enough to omit transfers between accounts.

Net Worth

This is the primary and best feature of the product. Your net worth updates every time you log in to the platform. It’s pretty remarkable. An updated and accurate calculation of your net worth is a pillar of financial success. Once your net worth exceeds 25x your annual expenses, congratulations you’re financially independent.

Cash Flow

Tracking your monthly cash flow is another pillar of financial success. With Personal Capital you can toggle date ranges to view your cash flows. Easily view what happened last month or over the last 12 months. Keep that cash flow positive and growing! Long-term trends are helpful for future planning. Personal capital does a good job of categorizing each transaction. When something is wrong or if you want to change it, it’s as easy as a few clicks.

Investment Income

Within the income tab, Personal Capital tracks interest, and dividend income. This gives you a view of all your assets across all your accounts generating passive income. Want to see the investment income accessible before retirement? Just toggle off all your retirement accounts. It’s that easy.

Asset Allocation

This may be my favorite tool within the platform. Calculating my asset allocation across all my investment used to take a long time. With Personal Capital, this happens automatically. All my assets in all my accounts pull in seamlessly to the Asset Allocation tool. From here I can see my net exposure to any asset class.

Each of my accounts has a specific goal and thus, a target asset allocation. The meta-view provided in Personal Capital gives me a birds-ey view or a sum of the individual parts. Asset Allocation is the only free lunch in investing. Make sure you know yours!

Retirement Planner

This tool is useful and requires a few extra details. It calculates the % chance you’ll hit your target retirement. It calculates this percentage using your profile and current investment portfolio. It’s a simple tool and can be viewed as directionally accurate. I would not rely only on this planning tool. It’s great for spot-checking progress, but ambitious early retirees need more robust planning.

How Much Does Personal Capital Cost

It’s free to open an account. It only takes your preferred email address and password. After that, you’ll have access to all the amazing dashboards, tools, and features of the platform. Personal Capital does run a freemium business model. This means they offer a free service to a large customer base and then attempt to upsell new customers. They upsell is their wealth management service.

This means that a Personal Capital team will reach out to you. They will ask you if you’re interested in becoming a wealth management client. The team is very friendly and offers a free consultation and review of the financial picture. I’ve had very friendly conservation with their team.

To become a member of their wealth management program, you’ll need a net worth of > $100,000 dollars. Members of the wealth management service pay an annual fee based on assets under management (AUM).

How Does Personal Capital Money Money?

Personal capital generates fee income from clients part of their wealth management business.

Fee Table

- Assets Over $100,000 dollars = Annual Fee of .89%

- Assets Over $1,000,000 dollars = Annual Fee of 0.79% to 0.49%

Who Owns Personal Capital

Empower Retirement acquired Personal Capital this year. For details check out the press release from personal capital. For details check out the press release from personal capital.

How to Sign Up for Personal Capital

It only takes a few minutes to create your account, and a few more minutes to link all your bank accounts. Access these powerful tools and incorporate them into your financial life.

Personal Capital Review: Your New Financial Dashboard

Personal Capital provides a simple and holistic picture of your net worth. It might be the best free money management tool out there.