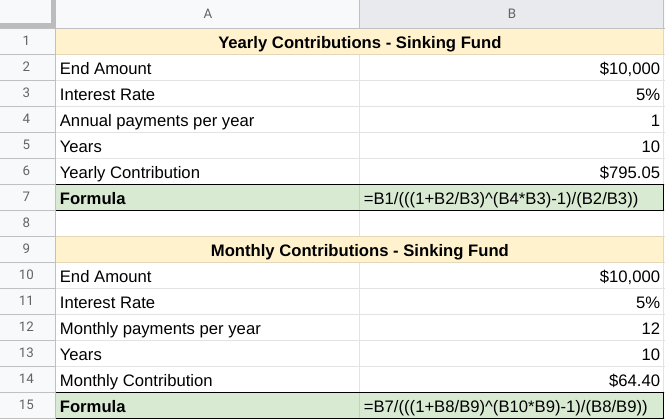

A sinking fund calculator is a useful tool for financial planning. This calculator determines how much you need to save per year to achieve a financial goal. Simply input the target savings amount, the interest rate you expect to get from your money, and how many years to plan to save.

- Money to accumulate = Target savings amount

- Annual Interest Rate = Expected return from invested dollars

- Rate compounding frequency = Select “Yearly” from the drop-down list

- Period = Type in how many years you plan to save and invest

- Required contribution = How much you need to save per year to achieve your goal

What to use a sinking fund calculator for?

All major expenses in your financial life benefit from planning. The more you can plan ahead, the less money you’ll need to save (principal) to achieve your goals. Time and compound interest will increase your money (capital) if you start early and invest your money.

Here’s a list of major life expenses to plan for. Use the sinking fund calculator to being the planning process.

- First apartment

- Engagement ring

- Wedding

- Honeymoon

- Car

- House, down payment

- College

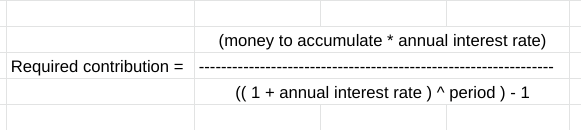

Sinking fund formula

Here’s the sinking fund formula with the variable names from the calculator.

Required contribution = (money to accumulate * annual interest rate) / (( 1 + annual interest rate ) ^ period) – 1 )